Overview

Singapore is positioning itself as a leading philanthropic hub in the region through a combination of government initiatives and private sector contributions to build a thriving ecosystem for philanthropy.

There are attractive tax incentives, including a 250% tax deduction for donations to Institutions of a Public Character. In addition, there are various donation matching programmes such as SHARE, Cultural Matching Fund, Enhanced Fund-Raising Programme, and endowment matching grants for tertiary institutions. These programmes amplify the impact of private and corporate donations by matching contributions at specified ratios, encouraging support for key causes.

The government also supports organisations that enable and strengthen the philanthropic ecosystem, such as the National Volunteer and Philanthropy Centre, the Wealth Management Institute, and the Community Foundation of Singapore. These entities facilitate connections between donors and meaningful causes, provide specialised training, enhance the ecosystem’s capacity to promote philanthropy, and offer advisory services.

To address donors’ interest in supporting international causes, the government has also introduced various schemes to attract donors to tap on Singapore as a hub for overseas giving. In 2023, the Philanthropy Tax Incentive Scheme was announced to allow single family offices to receive 100% tax deduction for overseas donations. This encourages international ultra-high net worth families to use Singapore as a base for their regional and international giving. Starting in 2025, the Overseas Humanitarian Assistance Tax Deduction Scheme will pilot a 100% tax deduction for individual and corporate donations to overseas humanitarian relief efforts, further positioning Singapore as a hub for regional and global philanthropy.

In the private sector, a few philanthropists have banded together to set up Asia Philanthropy Circle, a platform for Asia-based philanthropists to learn, exchange, and collaborate on philanthropic projects. Some philanthropists have also underwritten the administrative costs of philanthropic intermediaries such as The Majurity Trust and Asia Community Foundation to encourage more giving.

Other notable philanthropic initiatives in Singapore include the Philanthropy Asia Alliance by Temasek Trust, which promotes public-private-philanthropic partnerships to develop new strategies. Similarly, AVPN unites diverse social funders to advance various philanthropic initiatives.

This strategic blend of financial incentives, professional expertise, and institutional support positions Singapore as a vibrant philanthropic hub, attracting local, regional, and international donors as well as related stakeholders. The efforts probably contributed in part to the observed increase in philanthropic organisations and a surge in total giving in the third edition of Singapore’s Biggest Philanthropic Organisations list.

Singapore’s Biggest Philanthropic Organisations List

Singapore’s Biggest Philanthropic Organisations List identifies private philanthropic organisations registered in Singapore and ranks them by their annual grants disbursed in the latest financial year. The grants disbursed are based on publicly available data and can include grants given locally as well as internationally.

The 2024 edition identifies 117 organisations, up from 101 in the previous edition, with total giving reaching S$431 million—an impressive 96% increase from S$220 million in the prior 2022 edition. Nearly 30% of the total giving is coming from the top giver. Excluding this top giver, total giving this year would have also exceeded the previous total by about 38%.

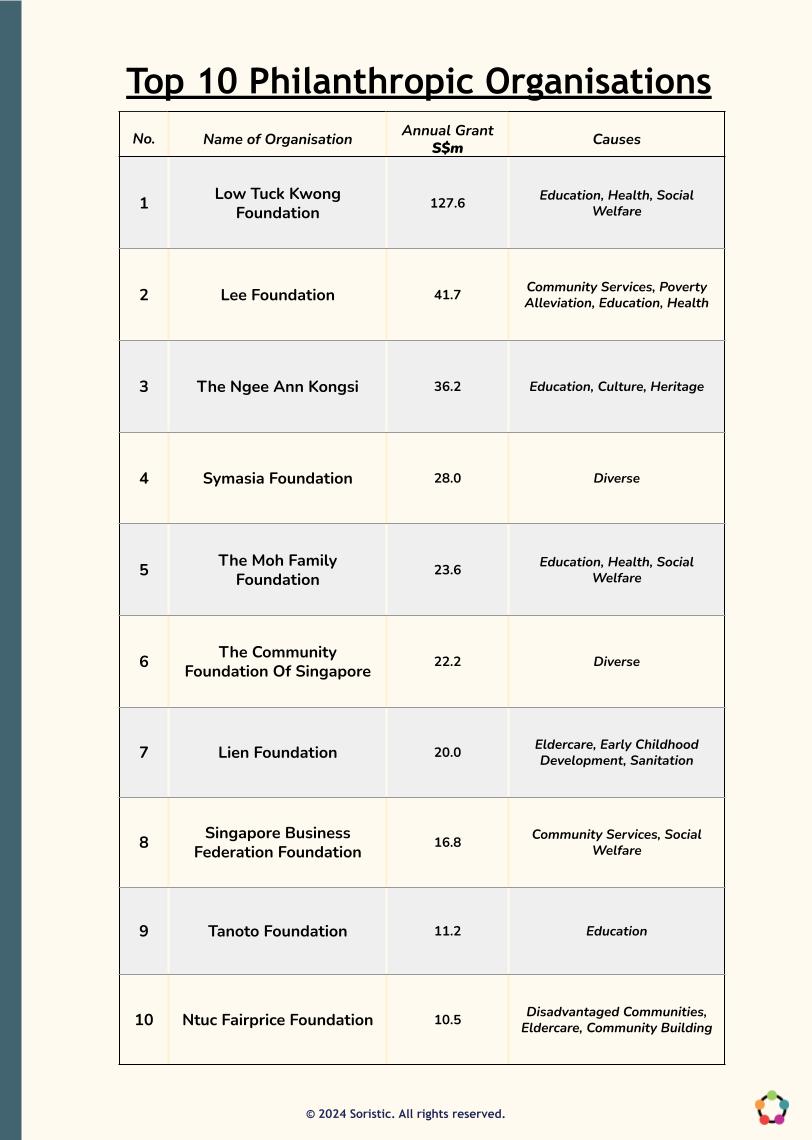

Notably, 40 organisations distributed over S$1 million each, and the top 10 accounted for S$338 million in total grants. The top ten givers include three new entrants, one of which is entirely new to the list. Among these top ten givers, five are affiliated to individuals/families, two are affiliated to corporates, two are donor-advised fund sponsors and one is affiliated to a clan.

The top giver is Low Tuck Kwong Foundation that disbursed S$127.6 million in 2023 to educational and healthcare causes. Established in December 2022, this foundation bears the name of Low Tuck Kwong, a philanthropist and businessman who built his wealth in the natural resources sector. According to its website, the foundation focuses on uplifting communities, empowering lives, and transforming futures across Southeast Asia. Notably, in 2023, it donated S$101.0 million to the Lee Kuan Yew School of Public Policy at the National University of Singapore, aiming to expand opportunities for the next generation of Asian leaders in public service and beyond. Other recipients of its support include hospitals in Singapore and the region.

The second biggest giver is Lee Foundation that disbursed S$41.7 million in 2023 to a diverse list of charities and causes. The Lee Foundation was established in 1952 by Dr Lee Kong Chian, a prominent banker cum businessman who left part of his estate to the foundation in his passing. Among the philanthropic organisations tracked, Lee Foundation is also by far the largest foundation by total asset size in Singapore with S$10.6 billion.

The third biggest giver is The Ngee Ann Kongsi, a Teochew philanthropic organisation that gave S$36.2 million in 2023 to educational, cultural, and charitable causes. The fourth biggest giver is SymAsia Foundation, a donor-advised fund (DAF) sponsor affiliated with Credit Suisse that gave out S$28.0 million in 2023. With the acquisition of Credit Suisse by UBS, it has been reported that the donor advised funds affiliated with Credit Suisse and UBS would merge.

The fifth biggest giver is The Moh Family Foundation, a family foundation recently incorporated in 2021. This foundation is established by the family of the late furniture tycoon, Laurence Moh and supports key causes including education, health, community well-being and social welfare internationally. Its disbursement of S$23.6 million in 2023 went mainly to health (75.1%), community wellbeing (14.2%) and social welfare (8.7%).

The next five biggest philanthropic organisations disbursed total grants between S$10.5 million to S$22.2 million in the financial year 2023 or 2024. The Community Foundation of Singapore, the pioneer DAF sponsor in Singapore, focused primarily on charities in Singapore disbursed S$22.2 million in grants to various charities. Lien Foundation, a family foundation, disbursed S$20.0 million. Singapore Business Federation Foundation, a foundation of the business community, disbursed S$16.8 million to champion the social, vocational and educational upliftment of disadvantaged Singaporeans. Finally, Tanoto Foundation, a family foundation, and NTUC FairPrice Foundation, a corporate foundation, disbursed S$11.2 million and S$10.5 million respectively in 2023.

Examples of Schemes Targeting Philanthropy in Singapore

Philanthropy Tax Incentive Scheme

This scheme is targeted towards single family offices and allows them to receive 100% tax deduction for a period of five years starting from 2024, capped at 40% of donor’s statutory income, for overseas donations made through qualifying local intermediaries. The scheme is meant to encourage single family offices to use Singapore as a base when they give overseas.

Overseas Humanitarian Assistance Tax Deduction Scheme

From January 2025 to December 2028, individual and corporate donors can claim a 100% tax deduction for overseas cash donations made through designated charities. Eligible donations must address emergency humanitarian needs arising from specific incidents, such as natural disasters or crises, and assistance can include rapid delivery of essentials such as food, clean water, shelter, medical care, and search, rescue, and evacuation efforts.

Enhanced Fundraising Programme

Since 2006, Tote Board has provided matching support to the fundraising efforts of local charities to encourage community giving. Since 2021, the Singapore Government has also been supporting this matching programme. Currently, the programme provides dollar-for-dollar matching, up to S$250,000 per charity, for eligible fund-raising projects of charities.

Matching Grants for Tertiary Education

Since 1991, the Singapore Government has provided matching grants for donations to tertiary education institutions. The matching ratio varies based on the institution and type of gift. For instance, newer universities receive up to a 3:1 match for endowed gifts and a 1:1 match for non-endowed contributions.

Data Collection & Methodology

This is the third edition of the report, with earlier versions published in 2021 and 2022. It examines philanthropic organisations registered with the Inland Revenue Authority of Singapore (IRAS) and/or the Commissioner of Charities (COC).

Organisations not considered include those primarily funded by public donations or government sources, as well as philanthropic organisations that are politically affiliated, faith-based, or government-related. Faith-based and politically affiliated grantmakers are excluded because many do not publicly disclose their grantmaking amounts or activities, and some restrict grants to recipients of the same faith. Similarly, funds and trust entities established for specific charities, such as school funds designated exclusively for their beneficiaries, are not considered. Organisations that have suspended activities are also excluded.

Data was compiled from publicly accessible sources, including annual reports, the Charity Portal, and official organisational websites, between September and November 2024. Figures are standardised to Singapore dollars, and the ranking is based on the most recent annual grant disbursements between financial year 2022 to 2024. Majority of the data come from financial year 2023. Organisations with data earlier than 2022 as well as those with no publicly available grant data are unranked.

Limitations

This report relies on publicly available data. Some philanthropic organisations in Singapore may not be registered as charities with the Commissioner of Charities (COC) or listed as grantmakers with the Inland Revenue Authority of Singapore (IRAS). These may include family offices that allocate a portion of their resources to grantmaking or philanthropic funds established by wealthy donors and managed by private banks in Singapore. Due to the lack of publicly available information, such grantmaking is not included in the list.

Grant amounts were primarily obtained from financial statements or annual reports. In cases where data lacked clarity or detail, reasonable assumptions were made to estimate the grant amounts disbursed.

Future of Philanthropy in Singapore

The third edition of Singapore’s Biggest Philanthropic Organisations List highlights the rapid strides in institutional philanthropy, supported by a robust ecosystem of government initiatives, private sector contributions, and a growing network of philanthropic organisations. Amongst the top 10 givers, the three new entrants — Low Tuck Kwong Foundation, The Moh Family Foundation, and Tanoto Foundation — are philanthropic organisations led by principals who amassed their wealth outside of Singapore. Through strategic incentives and innovative partnerships, Singapore is fostering a vibrant local ecosystem while establishing itself as a regional and global leader in philanthropy for the future.

The full list of the 117 philanthropic organisations – including information such as their latest grants disbursed, assets size, causes supported, website and email address – is available for purchase at $80. To purchase the full version, please click here. For charities, there is a 15% discount. Please email us at connect@soristic.asia